Is your content making you income?

The ATO has warned content creators that they need to be aware of their income tax and GST obligations. Tip: Examples of content creators are …

The ATO has warned content creators that they need to be aware of their income tax and GST obligations. Tip: Examples of content creators are …

The Australian Securities and Investments Commission (ASIC) has released results of its recent review on improving arrangements for life insurance in …

The ATO has recently reported there is now $16 billion in lost and unclaimed super across Australia, and is urging Australians to check their MyGov …

Late in 2022, amendments to the tax law passed Parliament that, among other things, included a measure to allow the ATO to issue a “tax-records …

It’s FBT time again, and for the 2022–2023 FBT year it’s important to remember that your business may be able to get an exemption for certain eligible …

Families struggling with the current cost of living crisis could soon have some relief with cheaper child care coming mid-year. The recently passed …

In an attempt to repair the Federal Budget and lower the overall national debt, the government is seeking to introduce changes to the way …

In a bid to increase the accessibility and affordability of quality financial advice, the government had previously commissioned a report into …

As a part of its ever-tightening compliance net, the ATO has recently announced it is targeting specific tax avoidance behaviour in the …

Employers that have provided FBT car parking benefits for the 2022–2023 FBT year should be aware that the ATO has finalised the changes to its ruling …

A new revised fixed-rate method for calculating working from home expenses will soon apply. From 1 July 2022, employees who work from home can no …

If you’re thinking of starting a self managed superannuation fund (an SMSF) in 2023, you need to be aware of the recent changes made by the ATO on …

The Federal Government has announced that it will abolish the Administrative Appeals Tribunal (AAT) and replace it with a new Federal administrative …

As a part of the Federal Government’s strategy to combat the tax compliance risks posed by the sharing economy, it has passed into law new …

The ability of the Family Court to divide the assets owned personally by a couple – including superannuation – on a relationship breakdown is largely …

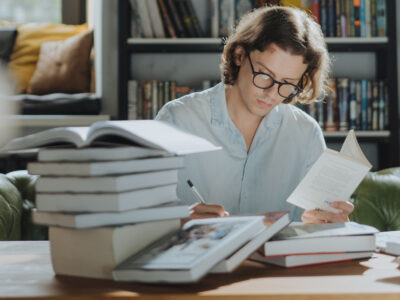

Self-education expenses are generally tax-deductible for individuals if there’s a sufficient connection with your income-producing activities. …

The Federal Government has showed its hand in terms of potential future changes to the Australian superannuation system. The Assistant Treasurer and …

As inflationary pressures start to bite, many businesses may be seeking rental deferrals or variations from their landlords to help them through this …

Businesses that provide FBT car parking benefits should be aware that the ATO has recently released an updated consolidated draft taxation ruling that …

Yes, it’s that time of year again! As the so-called “silly season” gets underway, and with many employers reverting to pre-pandemic norms around meal …

Treasury has released draft legislation which proposes two new grounds under which the Registrar of the Australian Business Register may cancel an …

Taxpayers could soon be dealing with more paperwork at tax time, or facing the prospect of a lower tax deduction for work from home (WFH) expenses. …

In a bid to protect consumers, the Federal Government has released a consultation paper seeking views on options to regulate the “buy now, pay later” …

When it comes to legal compliance by self-managed superannuation fund (SMSF) trustees, the ATO’s main focus is on encouraging trustees to comply with …

The Australian Securities and Investments Commission (ASIC) is the body responsible for overseeing the operation of Australia’s financial services …

In a bid to support pensioners and in conjunction with the announcement of its intention to reduce the eligibility age for downsizer super …

According to the latest Australian Security and Investments Commission (ASIC) report into retail investment, the uptake in cryptocurrency has …

As a part of its strategy to address the current skills shortage and future-proof Australia’s workforce by building better trained and more productive …

Are you having doubts about using your self managed superannuation fund (SMSF) for your retirement? Whatever your age, if recent market conditions, …

The ATO has reminded trustees of self managed superannuation funds (SMSFs) that COVID-19 relief measures that previously applied for the 2019–2020, …